Max Earnings For Social Security 2025

Max Earnings For Social Security 2025. For earnings in 2025, this base is $176,100. The social security administration (ssa) has announced that the maximum earnings subject to the social security payroll tax will increase by $7,500 in 2025.

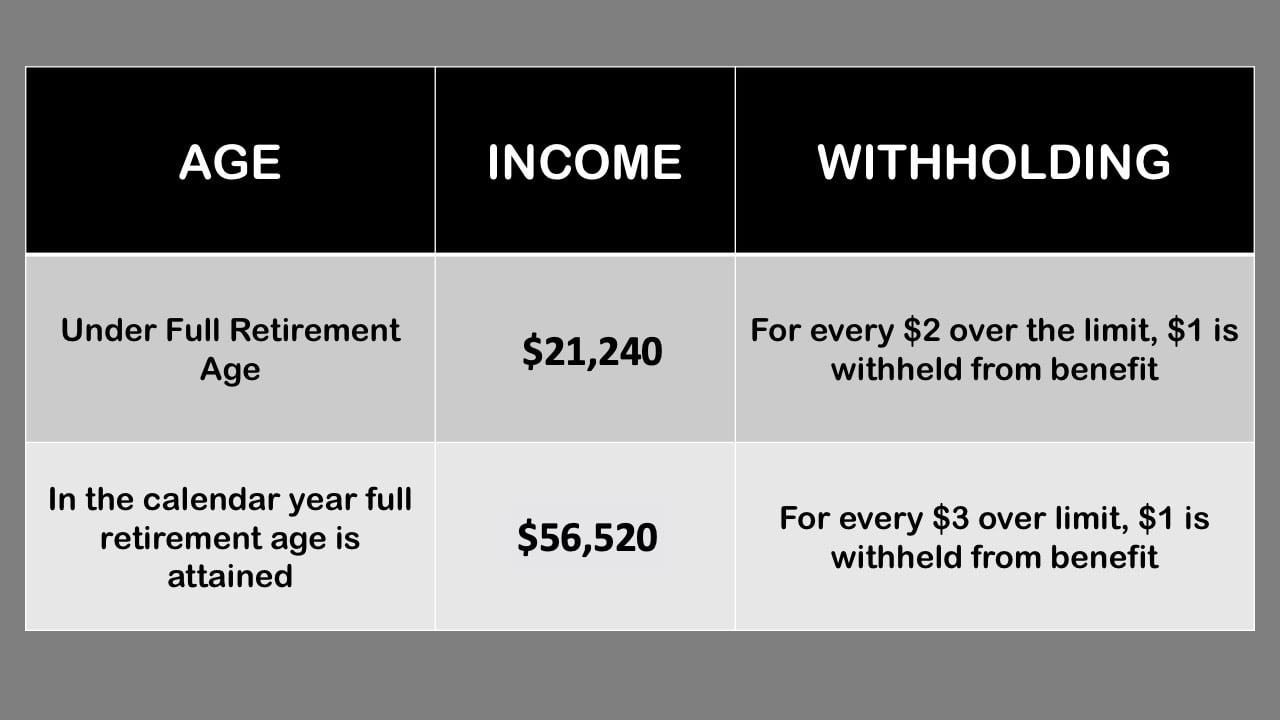

Working while you collect social security can have a negative impact on your benefits. This cap is the maximum taxable earnings limit, and it’s the highest income subject to social.

Social Security Update January 3, 2025 Payment Recipients Unveiled, This cap is the maximum taxable earnings limit, and it's the highest income subject to social.

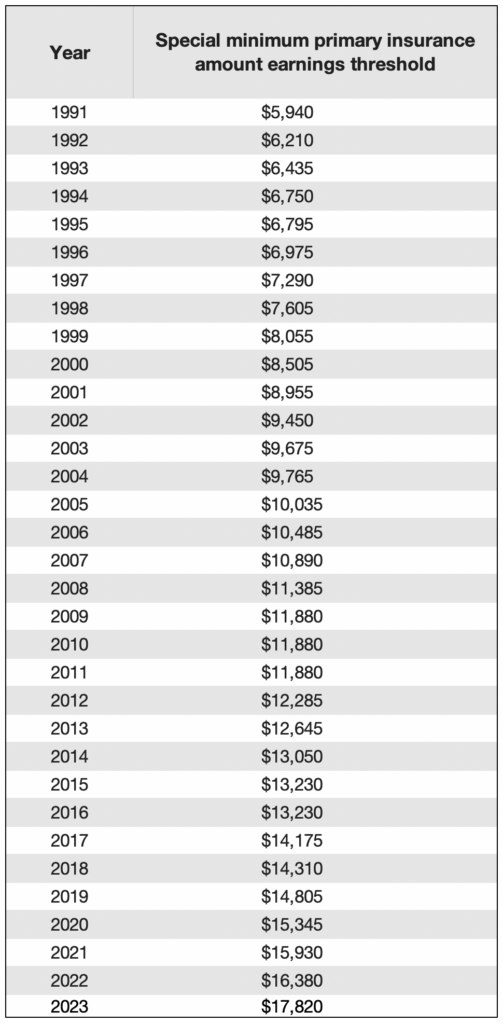

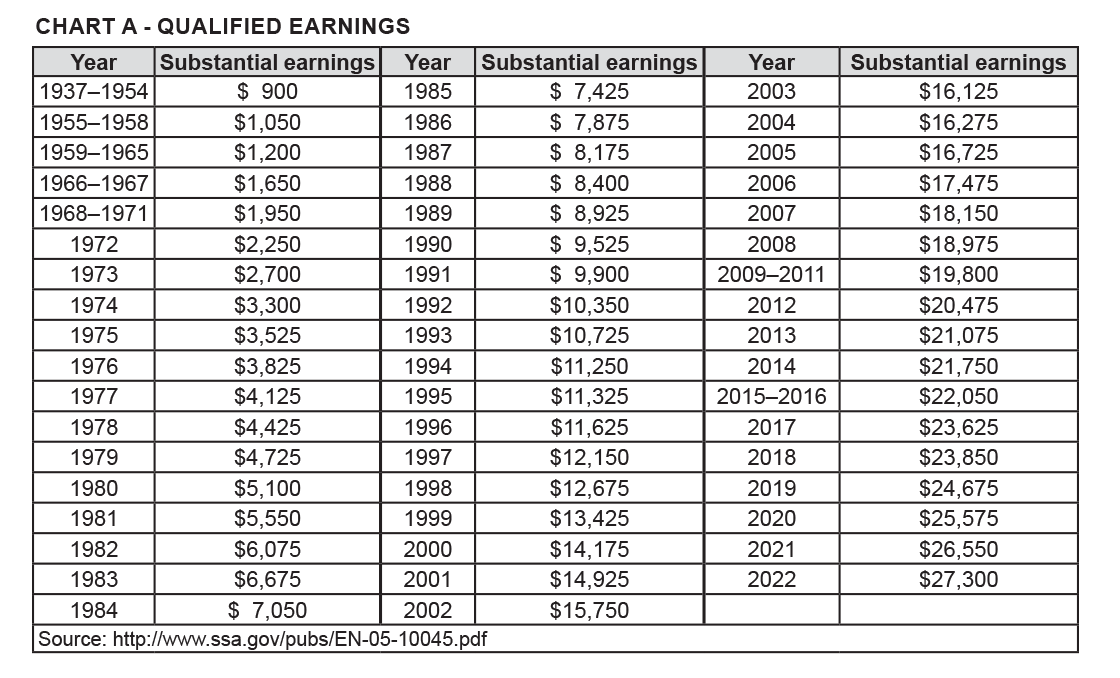

The Importance Of Social Security Benefits, Eligibility, And, The table shows average indexed monthly earnings (aime) —an amount that summarizes a person's earnings—and the corresponding monthly benefit amounts.

What is the Minimum Social Security Benefit? Social Security Intelligence, The maximum amount of income subject to tax for social security in 2025 is $176,100.

Annual Limit For Social Security 2025 Sammac Donald, This means that someone earning $176,101, $1 million, and $10 million in 2025 will all pay the same amount of social security.

(COLA) Update for 2025 Revealed! Social Security, SSDI, SSI, Low, This means that someone earning $176,101, $1 million, and $10 million in 2025 will all pay the same amount of social security.

Social Security Max Taxable Earnings 2025 Lok James Saif, Use this guide to learn about the social security income limit.

2025 Max Social Security Tax Noah Zahir, Currently, you can earn up to $22,320 without having your social security.

Social Security Max 2025 Benefit Arturo Levi, For 2025, the social security tax limit is $176,100.